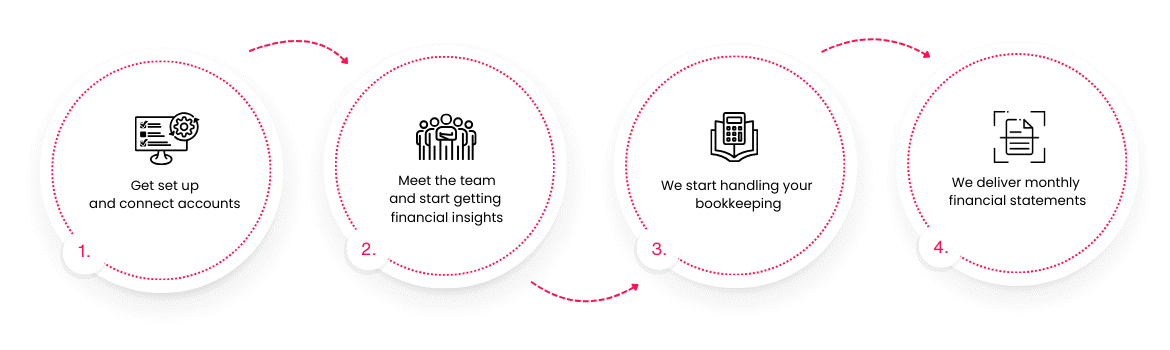

Our Process, Your Results

We specialize in managing the books for small businesses and can ensure amazing communication and accuracy.

About Us

One Of The Fastest Way To Gain Business Success

For over 20 years, ClearView LLC has been a trusted partner for businesses, offering comprehensive accounting, financial reporting, and advisory services. Our expertise ensures financial stability, compliance, and strategic growth for our clients.

ClearView LLC is built on the foundation of precision, transparency, and dedication. Our team of skilled professionals specializes in financial strategy, bookkeeping, tax planning, and business consulting. Whether you’re a startup or a well-established enterprise, we provide the insights and solutions to optimize your financial health.

- Nsectetur cing elit.

- Suspe ndisse suscipit leo.

- You’re going passage.

- Lorem ipsum gen on tend.

Team

Our Expertise

TEAM

The ClearView Advantage

At ClearView LLC, we don’t just manage numbers—we drive results. Our expertise spans multiple industries, providing personalized financial solutions that align with your business goals.

Our Vision

To revolutionize financial management for businesses by providing innovative, data-driven, and growth-oriented solutions.

Our Mission

To revolutionize financial management for businesses by providing innovative, data-driven, and growth-oriented solutions.

Our Process

To revolutionize financial management for businesses by providing innovative, data-driven, and growth-oriented solutions.

Our Team

To revolutionize financial management for businesses by providing innovative, data-driven, and growth-oriented solutions.

TAKE CONTROL OF YOUR FINANCES TODAY

Expert accounting, financial reporting, and advisory services tailored to your success.

Frequently Asked Question

These FAQs provide a balanced overview of company services and approaches.

Maintain records of income, expenses, receipts, bank statements, and any documents supporting deductions or credits claimed.

It’s advisable to keep financial records for at least seven years, as the IRS can audit returns within this period.

The required tax forms depend on your business structure (e.g., sole proprietorship, LLC, corporation). Consult with a tax professional to determine the appropriate forms.

Bookkeeping involves recording daily financial transactions, while accounting encompasses interpreting, classifying, analyzing, reporting, and summarizing financial data.

WHAT CLIENT'S SAY?

Success is the result of perfection, hard work, learning from failure, loyalty, and persistence.Id mattis augue nunc, urna sit pharetra. In sed turpis convallis sed. Diam mauris, nullam non sed diam massa non. Ornare quis..

Kane Williamson

- Makerting

Id mattis augue nunc, urna sit pharetra. In sed turpis convallis sed. Diam mauris, nullam non sed diam massa non. Ornare quis pulvinar congue nulla massa pharetra. Tincidunt erat fermentum, mattis nunc, ipsum, sed sollicitudin…

Liya

- CEO

Id mattis augue nunc, urna sit pharetra. In sed turpis convallis sed. Diam mauris, nullam non sed diam massa non. Ornare quis pulvinar congue nulla massa pharetra. Tincidunt erat fermentum, mattis nunc, ipsum, sed sollicitudin…

John David

- Manager

Our Vision

What We Have To Offer